.svg/1200px-Microsoft_Office_Excel_(2019–present).svg.png)

Tools such as Excel with MarketXLS enabled can help in analyzing the strategies.īenefits of using ExcelOptions are a completely different asset class than stocks, they move differently, and they trade differently. If you want to analyze the payoff vs risk for each of them, it becomes cumbersome and tiring to calculate the max profit/max loss for each option/strategy. But in any exchange, there are many options available at different prices and different strike rates. can help you to make money and limit risk. Why Use Tools Such as ExcelSome of the strategies like covered call, protective put, bull call spread, etc. Nowadays, there are tools available through which you can keep a track of all the options activity and also assist with the most common problems that I see options traders face.

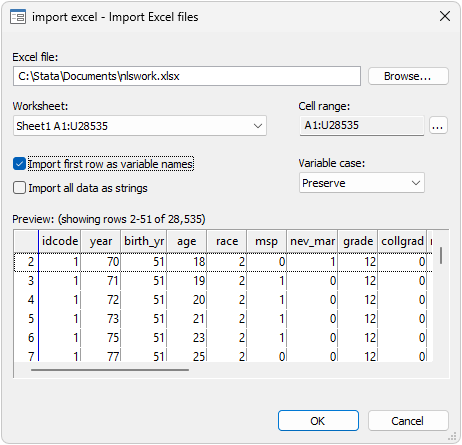

But it doesn’t have to be that way for you. That’s why it’s so important to proceed with caution.Īlso, many traders who try options suffer losses in the beginning. It is possible to lose more than the entire amount you invested in a relatively short period of time when trading options. However, there is a learning curve you must go through first. Also, options provide many ways to protect and hedge your risks against volatility and unexpected movements in the market. You can use option strategies to cut losses, protect gains, and control large chunks of stock with a relatively small cash outlay. When trading options, it’s possible to profit if stocks go up, down, or sideways. Options trading can be extremely lucrative. Options Trading – Can It Be Made Simpler? But before starting let us understand why beginners must be extra careful with options trading and if there a way to simplify options trading. At the end of the article, I’ve provided a link to the video tutorial for options pricing in excel using MarketXLS. In this post, I will be explaining how the use of excel and similar tools can be beneficial for options trading.

0 kommentar(er)

0 kommentar(er)